The great trade execution debate.

Trade execution models and the terms STP, ECN, DMA, B-book / A-book, MM are widely discussed and often casually thrown about in conversations between traders and brokers. However, it goes so much deeper than this and getting an in depth understanding of an ideal execution model, its setup and what would be considered best practice is paramount.

Trading volumes and the truth.

Brokers often release monthly trading volumes to the public, but how do we know who is listing the real volumes and what benefit do they get for falsifying? Trading volumes are often used as a quick view of the health of a broker thus leads to question how reliable the information is for those brokerages whom are not audited.

We look at how to decipher trading volumes and which jurisdictions can be trusted.

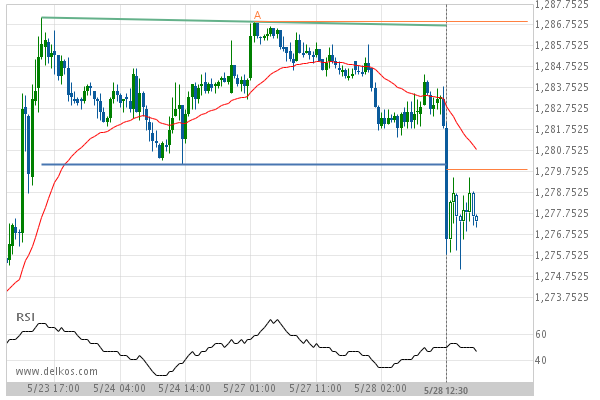

To Brexit or not to Brexit? Full currency analysis as EU referendum approaches (Brexit)

Volatility in the markets will be a given as Brits vote on the fate of Britain’s membership in the EU. Brexit is trending on social media and in the news but how will this affect currencies leading up to the referendum and afterward?

Eddie Topfik lays it out to FinanceFeeds. A must read if you are trading in the coming weeks.

“It depends how thick your crayon is!” Full commodity market analysis

An in depth look at what the commodity markets are up to, what can be expected and look at a few charts with Eddie Topfik.